Under Armour Inc - Class A Stock Forecast: down to 4.216 USD? - UAA Stock Price Prediction, Long-Term & Short-Term Share Revenue Prognosis with Smart Technical Analysis

Under Armour Inc - Class A Stock Forecast: down to 4.216 USD? - UAA Stock Price Prediction, Long-Term & Short-Term Share Revenue Prognosis with Smart Technical Analysis

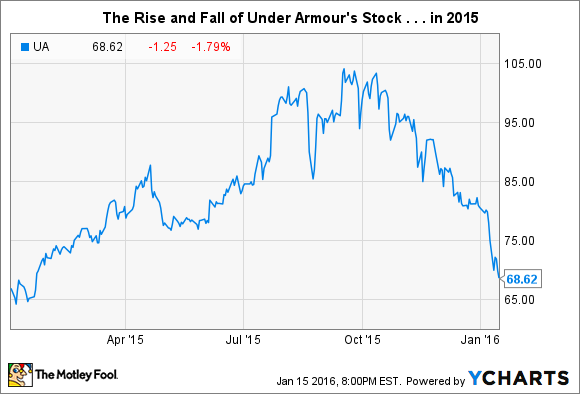

![Under Armour Inc (UAA) Stock 5 Years History [Returns & Performance] Under Armour Inc (UAA) Stock 5 Years History [Returns & Performance]](https://www.netcials.com/tools/phpgraphlib-master/image/nyse-stock-5years/5-year-monthly-price-chart-Under-Armour-Inc.png)